inheritance tax changes budget 2021

27 October 2021 3 min read Share Chancellor Rishi Sunak largely resisted the temptation to tinker with pension and inheritance taxes to fund his spending plans in his Autumn Budget on Wednesday. Heng Swee Keat in his Budget Statement for the Financial Year 2021 on Tuesday16 Feb 2021.

What Are Marriage Penalties And Bonuses Tax Policy Center

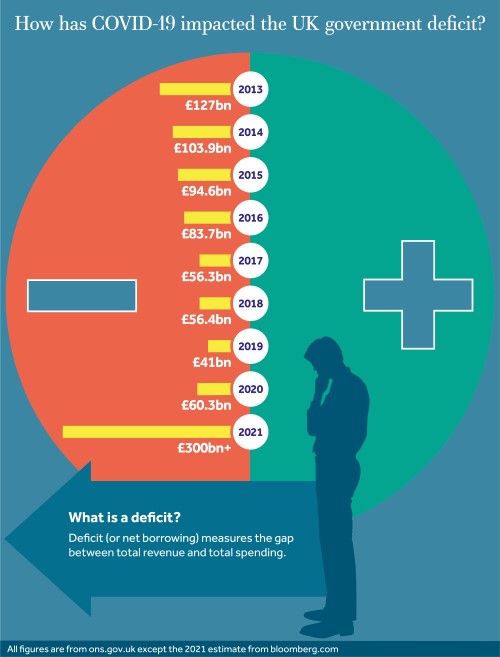

Budget 2021 announced 13 October 2020 featured record government expenditure of over 17bn against a backdrop of COVID-19 and Brexit.

. Contact our Edison NJ CPA firm at 732-777-1158 or request a consultation online to learn more about our inheritance tax services. It includes measures to support business including VAT rate cuts for the hospitality and tourism sectors and financial support for businesses closed by restrictions with critical. Much has been made of the Autumn Budget and the changes around Universal Credit and National Insurance but changes to other taxes are sometimes missed when reviewed by the media.

Mr Sunak will update any changes to. This could result in a significant increase in CGT rates if this recommendation is implemented. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances.

Budget 2021 - Overview of Tax Changes. The following tax changes were announced by Deputy Prime Minister and Minister for Finance Mr. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year.

10 on assets 18 on property. Changes To Inheritance Tax for Budget 2022. The changes in tax rates could be as follows.

Gifts and generation skipping transfer tax exemption amounts are indexed. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances. The Conservative Manifesto of 2019 ruled out increases in income tax VAT and national insurance and while the Government could argue that Covid changes everything with regards to Inheritance Tax in particular the current Nil rate band of.

In a nutshell everything remains the same. The rate of tax payable stays at 33. The rate of tax payable stays at 33.

1034 Thu Mar 17 2022. Here are our key takeaways from the Autumn Budget 2021 for Inheritance tax. The Government is set to introduce legislation in Finance Bill 2021 so that the inheritance tax nil-rate bands will remain at existing levels until April 2026.

Each individual has a tax-free allowance the nil-rate band of 325000. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. The residence nil-rate band was due to rise with inflation in April 2021 but both thresholds have been frozen until 2026.

If a person gives away a property to a. Budget 2021 - Changes to Inheritance Tax. 0818 Wed Oct 27 2021.

While there have been no earth shattering changes to the system of Inheritance Tax in the UK. Tax rates and allowances. The income tax limits and personal allowance will remain at their.

In addition the residence nil-rate band will also be frozen at 175000When added to the IHT threshold of 325000 it allows each individual to pass on 500000 with no IHT payable - or 1m per. Inheritance Tax changes. These included aligning rates of CGT to income tax levels and cutting the annual gains allowance from 12300 to as little as 2000 per person but with fewer assets attracting the charge.

Budget 2021 Predictions for Capital Gains Tax Inheritance Tax and Income Tax Following the announcement on 22 February 2021 there finally seems to be some light at the end of the tunnel. Following the release of Budget 2022 the 3 main thresholds remain as they were as does the rate of tax payable on any amounts inherited in excess of the thresholds. No changes to reliefs including APR and BPR.

An increase in capital gains or inheritance tax and the complete elimination of the step-up basis will capture billions. The residence nil rate band RNRB was due to start increasing in. No increases to capital gains tax and inheritance tax rates or allowances.

Posted on 29th April 2021 at 1236. The OTS review of CGT published in September suggested four key changes as part of an overhaul. 20 on assets and property.

With the Chancellor announcing in the budget this year that the inheritance tax thresholds will be frozen at the existing levels until April 2026 have you made the most of your tax free allowances. Chancellor Rishi Sunak walking tax tightrope to balance Budget RISHI SUNAK has announced the Budget for 2021 and Inheritance Tax has featured in the announcement today. Rishi Sunaks second Budget of 2021 was largely about spending with little movement on personal tax - notably absent again was any mention of capital gains tax inheritance tax or pension tax.

The 30 day time limit for reporting capital gains on the sale of residential property and for payment of the tax has been increased to 60 days from Budget day. Budget 2021 - Changes to Inheritance Tax Posted on 29th April 2021 at 1236 With the Chancellor. Reducing the annual allowance would mean more people.

Given the rapidly rising values in many asset classes. The Autumn Budget has frozen this useful nil rate band until at least 2026. Proposed changes to Capital Gains Tax.

The government has announced that the inheritance tax IHT threshold will remain frozen at 325000 until 20252026. There are currently two tax-free allowances for inheritance. This is called entrepreneurs relief.

Our firm offers many years of experience in estate tax compliance so you can be confident that your clients estate tax returns will be calculated accurately and filed on time every time. The full Budget Speech package is available at the Singapore Budget website. The Treasury is reportedly looking to hike its tax intake in this Autumn Budget with Inheritance Tax.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

Inheritance Tax Budget 2021 Nil Rate Band

Tax Highlights From Budget 2021 Advisor S Edge

Post Covid 19 Tax Planning Be Prepared For Tax Rises Cgwm Uk

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

What Are The Consequences Of The New Us International Tax System Tax Policy Center

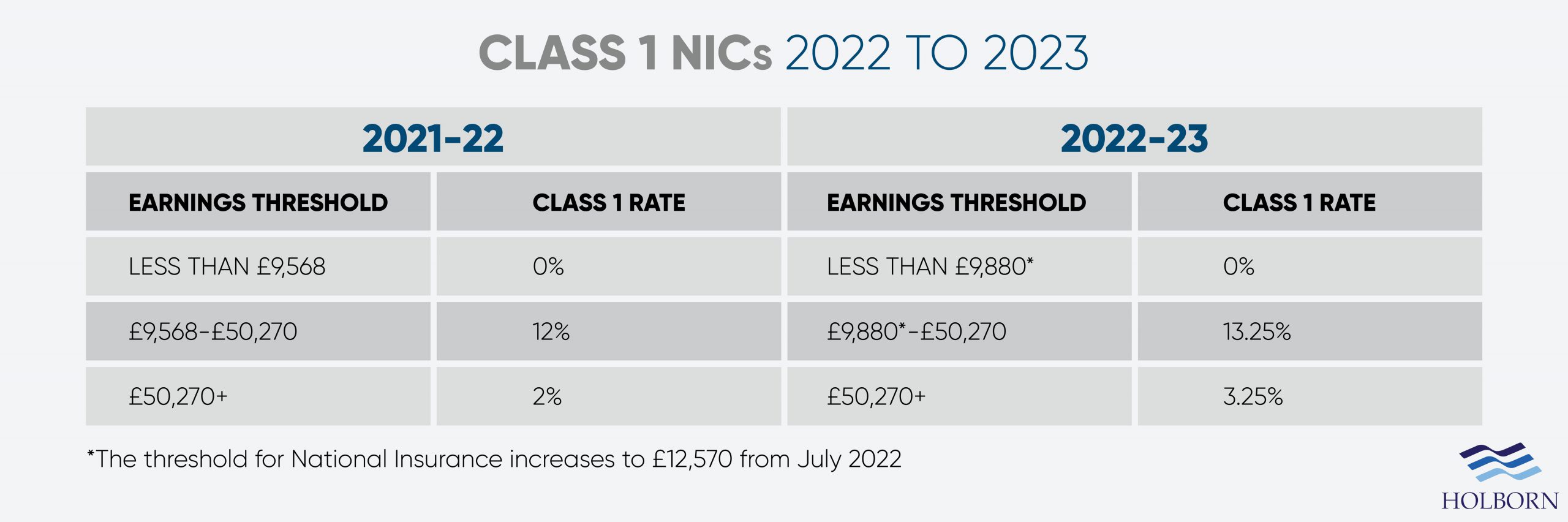

Changes To Uk Tax In 2022 Holborn Assets

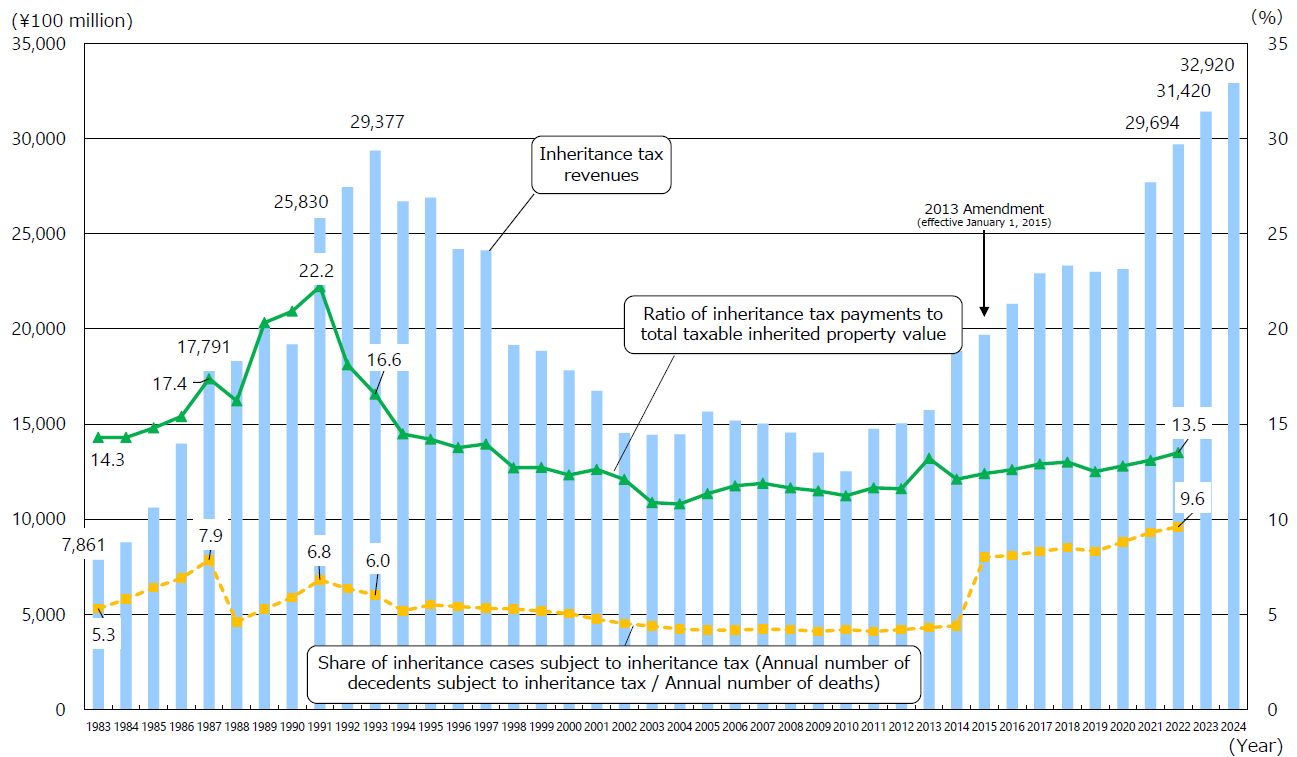

Materials On Asset Taxation Ministry Of Finance

The Curious Task Of Redistributive Taxes Inheritance And Corporate Taxes Berkeley Political Review

Canadian Inheritance Tax Myths And Facts Bnn Bloomberg

What Is The Tax Expenditure Budget Tax Policy Center

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

No Inheritance Tax In Canada Was Not Secretly Raised To 46 Percent Fact Check

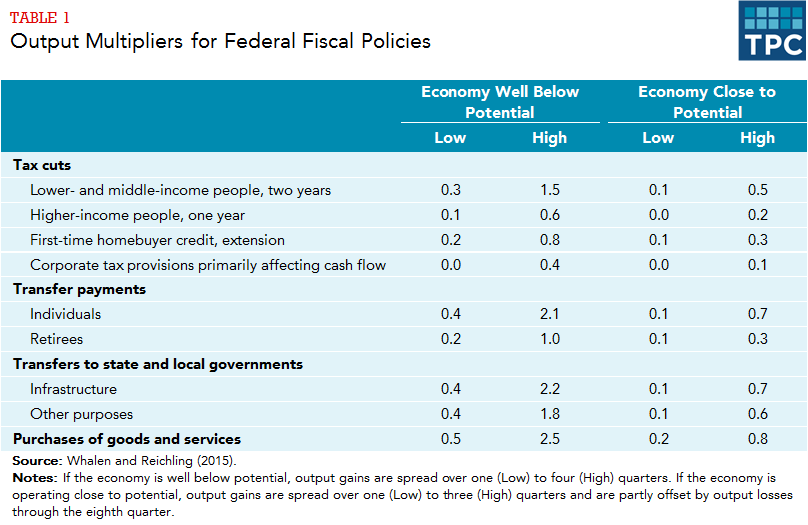

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Liberals May Be More Open To Ndp Tax Proposals In New Parliament Experts Say Advisor S Edge

Budget Summary 2021 Key Points You Need To Know

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily